Forage Into The Future #4

On: 'VC Pause', Unicorn Slow-down, a booming BioTech sector, using AI to revive loved ones, sun-powered water purification, creating self-healing 'anthrobots' from human cells and planetary defense

Hello everyone!

In this edition of the Forage Into The Future newsletter, you can find updates on 🦄Venture Capital & Private Equity, 💻AI, ♻️Sustainability, 🚀Space and 🧬Genomics & Biotechnology.

A little bonus at the end: Given that it’s the end of the year, a list of outlooks for 2024 (from 23 banks, 18 asset managers, 4 PE funds, and 4 consulting firms) that you may find interesting if you’re currently involved in economics, credit or finance.

🦄 Venture Capital & Private Equity

Hitting Pause?⏸ According to a recent report, a substantial 38% of U.S.-based active VC investors hit the pause button on dealmaking in 2023. Pitchbook notes that 2,275 VC investors are no longer active according to their data (the level of activity defined by Pitchbook is ‘making two or more deals’). This suspension of their activities is possibly due to running out of funds or being associated with inactive funds. Some are offloading portfolio stakes, while others may be strategically waiting for more favorable startup valuations.

Was this decline a long-time coming? Zooming out, limited partners anticipate a decline in the number of VC funds, with notable firms like OpenView halting new investments and returning capital to LPs. [Hard to miss given the prominence of OpenView but generally by most accepted standards, it takes 3-4 years for the ‘cracks’ to begin to show through.]

Sparking Up!💰 Spark Capital is gearing up to raise two new funds totaling $2.1B according to SEC filings.

Based on public SEC records, the funds include $700M for their early-stage flagship fund (its 8th flagship fund) and $1.4B for their fifth growth-stage fund.

Spark Capital, known for backing Twitter, Oculus, Coinbase, and Slack, raised a similar amount in early 2022.

They have also been bullish on AI, having led a $300M round into Anthropic (at a pre-money valuation of $4.1B) and co-led a $350M Series B round with General Catalyst into Adept AI (at a post-money valuation of $1B) earlier in the year.

Generally, ‘Direct alpha’ and ‘Kaplan-Schoar’ are two of the most widely used metrics to evaluate a fund's performance.

With the year drawing to a close, interesting insight on everyone’s favorite mythical creature at this point: the ‘creation of fabled unicorns in Europe’. The creation of unicorns in Europe has witnessed a notable deceleration in 2023, marking a contrast to the prolific surge observed last year - which was the second highest unicorn creation rate for the region (behind only 2021).

Mega-funding rounds have somewhat tempered, sparking discussions about the future trajectory of such endeavors.

Interestingly, this year 10 European companies reached a unicorn status, compared to a staggering 46 last year!

Reverb from 2022? My assumption would have been that the impact was already being witnessed towards the drag end of last year as well, and we only saw an uptick in the numbers on the back of extremely strong Q1 and Q2 fundraising for European unicorns. This is largely predicated on the fact that by Q3, only 4 new unicorns were minted last year (vs. 36 in the first 2 quarters)

As the unicorn creation rate ebbs, one ponders: What forces will reignite the momentum in 2024? Are we witnessing a ‘recalibration’ or a ‘precursor’ to a new era in European startup dynamics?

The key theme has been an immense surge in investing into AI, specifically generative AI. (No prizes for guessing that at this point eh?)

A recent report from Carta on VC Shifts unveiled some interesting insights into the sectoral distribution of capital:

The biotech seed market is experiencing a significant surge, with seed valuations soaring by 190% from Q1 2020 to Q3 2023. The focus on vaccines and pharmaceuticals post-pandemic is a likely contributor to this remarkable increase.

Biotech startups have claimed nearly 16% of total venture capital raised in the first three quarters of 2023, marking a six-year high. This is a stark contrast to the share of SaaS startups, which just so happens to be at its lowest in the same period, accounting for just 28.4% of capital raised.

From general biotech startups to a fund that focuses on biotech - some segues just happen seamlessly. Hadean Ventures announced the final close of its second fund at €144m, surpassing the targeted €125m. The total committed capital for Hadean Ventures' two funds now stands at approximately €230m.

Strong backing from existing investors and new participants like EIF, KfW Capital, and Tesi demonstrates robust confidence in Hadean Ventures' strategy focused on life science start-ups across Europe, with a specific emphasis on the Nordic + German-speaking countries.

Since its launch, the second fund has invested in six companies: Alex Therapeutics, Arthex Biotech, Complement Therapeutics, Emergence Therapeutics, Ribbon Biolabs, and TargED.

The first exit, the acquisition of Emergence Therapeutics by Eli Lilly, surpassed expectations according to Investors.

Red Cell Partners, a VC firm led by ex-Rally Health founder Grant Verstandig and ex-Defense Secretary Mark Esper, has raised $91.2M for pre-seed to follow-on investments in AI & ML-powered startups in healthcare and defensetech. They aim to incubate companies and bring them to market with contracts in hand in under 2 years. Recent examples include Defcon AI (defense logistics ML) and Savoy Life (long-term care software).

💻 AI & Robotics

Warehouse robotics startup GreyOrange closed $145M in Series D funding, with Anthelion Capital leading the charge. Existing investors Mithril, 3State Ventures, and Blume Ventures contributed to the round, signaling a robust future for robotic solutions in warehouses.

For eons now, humans have found ways to deal with the grief and the loss of of a loved one. China is experiencing a trend where some Chinese firms claim to have "digitally revived" thousands of deceased people using artificial intelligence (AI) technology.

♻️ Sustainability

Touching upon some themes that we covered in the three-part bit on GreenTech/Sustainability Trends previously, this device operates similarly to an "artificial leaf" but with a crucial distinction—it can function with polluted or seawater sources, simultaneously producing clean drinking water.

The device is operable with any open water source, eliminating the need for external power sources and proving particularly beneficial in remote or developing regions.

The research team successfully overcame challenges associated with solar-driven water splitting, the researchers designed a device that can work with contaminated water without the risk of catalyst poisoning or unwanted chemical side-reactions.

The device optimizes solar energy usage by employing a white, UV-absorbing layer for hydrogen production and transmitting the rest of the solar spectrum to the bottom, where water vaporization occurs.

This could, theoretically at least, address both energy and water crises globally. (the lack of safe drinking water is still a herculean challenge for 1.8 billion people worldwide.)

Current stage: Still proof of concept, but immense potential.

Plenitude, an energy transition company, recently received an injection of €500 million in capital from EIP into its capital structure, with the potential to increase the total investment to €700m.

Its aimed at integrating renewable energy generation assets, retail services, and electric vehicle charging points. Plenitude currently operates nearly 3 gigawatts of carbon-free generation capacity and approximately 20,000 EV charging points, serving 10 million retail customers across 15 countries.

Plenitude aims to double its renewable generation capacity to 7 gigawatts, expand charging points to 30,000, and increase earnings to €1.8 billion by 2026.

🔋 Northvolt AB secures a substantial $1.2B in funding to enhance battery production. The Swedish battery maker plans to utilize the funds to scale up production at its Northern Sweden facility.

This round extends last years convertible note offering - done in two stages of $1.1B and $1.2B respectively - to $3.5B.

Danica Pension, KfW, CDPQ, East Innovate, and Investissement Quebec provided the latest funding, bringing the total equity and debt funding raised to date to $10B.

Its losses also grew eightfold to a total of $1.1B.

Solar power growth is currently exponential - with the potential for a terawatt to be deployed annually in just a few years. Some are saying that “no single energy technology ever in history has grown as massively steeply as (solar) photovoltaics”.

Uwe Dahlmeier of DR Dahlmeier Financial Risk Management AG states that “Based on empirical evidence, the long-term global exponential trend for solar is unlikely to slow down before the end of the decade and probably not before 2034, if only due to the favorable prices of solar power from new systems.”

They are also forecasting that by 2030, global solar deployments could exceed 14 TW, implying a doubling of capacity approximately every two years.

Germany is Going Green: For the first time ever, Germany generated more than half of its electricity with renewable energy in 2023. According to preliminary calculations, renewables accounted for roughly 52% of the country's gross electricity consumption, marking a significant increase from 46% in 2022.

Renewables contributed particularly high shares of electricity in July (59%), May (57%), and October and November (55% each).

This achievement is driven by both a decrease in overall electricity consumption and a rise in renewable energy production. Renewables output jumped 6% to a record high of 267 TWh, while electricity demand fell. June saw record-breaking electricity generation from both solar (9.8 TWh) and onshore wind (113.5 TWh for the year).

Germany has ambitious goals for further ramping up renewables. The country aims for an 80% renewable electricity share by 2030 and a largely decarbonized power supply by 2035.

🚀 Space & Beyond

Chinese space startup Galactic Energy secures $154M (CN¥1.1B) in Series C and C+ funding. Ziyang Heavy Industry Fund spearheaded the round, with support from Bengbu Investment Group, Langfang Linkong, Jintuo Capital, and others.

A recently NASA analysis suggests that 17 discovered exoplanets could potentially harbor subsurface oceans beneath ice sheets (akin to the icy moons of Jupiter). These planets are considered promising candidates for the search for biosignatures—chemical signs of life.

While the exact composition of the exoplanets is unclear, previous studies indicate they are (a) significantly colder than Earth; and (b) are less dense (despite being of similar size).

The analysis suggests that these exoplanets may maintain internal oceans due to the decay of radioactive elements and tidal forces from their host stars. [Internal heating generated by processes like gravitational interactions and radioactive decay could keep water in a subsurface liquid state.]

They also suggest that internal heating could lead to cryovolcanic eruptions, similar to geyser-like plumes observed on Jupiter's moons Europa and Enceladus.

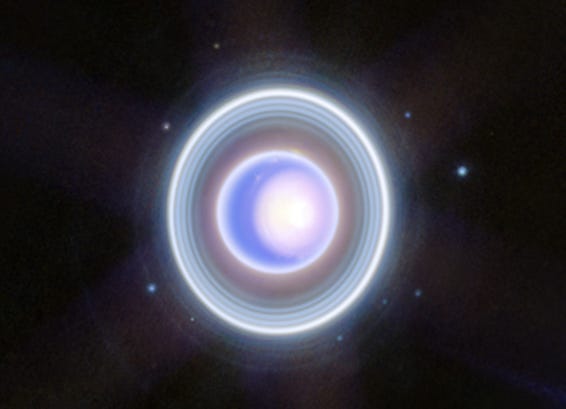

Some captivating images to put things in perspective: First is the JWST’s captured image of Uranus’ seasonal north polar cap and dim inner + outer rings (you can see 9 / 27 rings visible in the image) [Image credits: NASA, ESA, CSA]; and Second, is the Sh2-240 Spaghetti Nebula.

This maneuver involved two astronauts venturing outside the Tianhe core module to mend the front and outer sides of the solar panels.

In a 3-person task: the first astronaut (and the mission commander) utilized the space station's robotic arm to reach the damaged panels, while the second astronaut provided backup along a handrail. The third crew member, oversaw the robotic arm's movements from within the core module.

P.S. Tiangong is a space station in low-Earth orbit, comprising three modules: the Tianhe core module launched in 2021, and the Wentian and Mengtian experimental modules launched in the previous year. The space station is expected to operate for more than 10 years.

Researchers at Lawrence Livermore National Lab (LLNL) unveiled a powerful simulation tool to gauge the potential of using nuclear explosions for planetary defense against asteroids. Their model accurately maps the energy deposition from a nuclear blast on an asteroid's surface, considering factors like porosity, radiation intensity, and angle of impact. This comprehensive approach covers a wide range of potential scenarios. It’s also outlined that this research is being undertaken to add to the the learnings from the DART program that NASA undertook in Sept 2022 where a kinetic impactor was deliberately crashed into an asteroid to alter its trajectory.

🧬 Genomics & BioTech

Ori's platform is built on stackable, disposable cartridges, eliminating the need for complex clean rooms and manual processes. Need more capacity? Simply add more modules. No more unused space or expensive expansions. This has resulted in their purported ability to make 4,000 clinical doses in 4,000 sq ft of space.

Ori has built-in sensors and AI to optimize cell growth, ensuring consistent quality and faster production. The streamlined manufacturing (along with AI being added into the mix) means cheaper therapies and shorter wait times for patients.

Scientists at Tufts University have developed self-healing "anthrobots" from human cells. In lab experiments, these anthrobots, derived from adult human lung cells, prompted sheets of human neurons to repair themselves when damaged.

Anthrobots begin as single cells from adult human lungs, growing into multicellular biobots over a span of two weeks. The cells are equipped with cilia, hairlike structures that can be manipulated to enable movement in various patterns, showcasing adaptability in design. The researchers observed anthrobots promoting the healing of damaged neurons. When introduced to a simulated wound in a lab dish, anthrobots prompted neurons to regrow, bridging the gap created by the scratch. The healing process occurred without genetic modification.

Anthrobots offer scalability, allowing the production of swarms of bots in parallel & may have application in regenerative medicine.

In rat trials, the chip powered implants for 10 days, and even functioned as a drug-delivery system, administering anti-inflammatories. While hurdles remain - like refining size and controlling on/off functionality - this breakthrough paves the way for sleek, sustainable implants that also minimize the risk of infection that external modulators can cause.

The prototype power supply uses a magnesium coil that charges when a second coil is placed above the skin. Power passes through a circuit and then enters an energy-storage module made of zinc-ion hybrid capacitors.

There are still huge challenges like the fact that: (a) something that transmits electricity gets subsumed within the body?!; (b) the completely biodegradable nature of it; and (c) safety for long-term use.

Funding:

Lyndra Therapeutics closed a $101M Series E round recently. Sarissa Capital led the round, joined by Sun Pharmaceutical Industries Ltd. and Polaris Partners. Lyndra is focused on developing long-acting oral therapies with a focus on central nervous system disorders, aiming to reduce dosing frequency and broaden disease coverage.

Aro Biotherapeutics, a clinical stage biotechnology company pioneering the development of tissue-targeted genetic medicines (one of which is its drug for the treatment of Pompe Disease), earlier in the month had announced it has secured $41.5M in a Series B funding round, led by Cowen Healthcare Investments, with participation from Johnson & Johnson Innovation – JJDC, Inc. (JJDC), Northpond Ventures, Healthcap and BVF Partners, L.P

Pre-Bonus Bonus? I guess you could call it that, but if you’re interested in technology and the undeniable promise that accelerating it can bring, you cannot miss out on the MIT Technology Review’s look at the worst technology failures of 2023. (Hint: My personal favorite is the ‘Social media superconductor’, though the Titan submarine finishes a close second?)

📈 End of the Year Bonus? 2024 Outlooks: An Overview

USA / North American Banks & Financiers:

European Banks & Financiers:

Asset Managers:

Private Equity (PE):

Consulting & Audit Firms: