On OSAM: On Orbit Servicing - An Introduction

Like Calling 'AAA' when your satellite breaks down - only cooler and more nascent.

N.B:

OSAM, broadly:

One of the key market segments of the NewSpace economy that gets discussed is the On-Orbit Servicing, Assembly & Manufacturing (colloquially referred to as ‘OSAM’) segment. Though the name is pretty much self-explanatory, but think of it as being constituted by 3 top-level areas at varying stages of technological maturity (or infancy in the case of OOM):

OSAM = On-orbit Servicing (OOS) + On-Orbit Assembly (OOA) + On-Orbit Manufacturing (OOM)

Content Overview:

A. What is OOS + Sub-Segments of OOS

B. Mission Sequence of the OOS Process

C. Demand-Side Drivers for On-Orbit Servicing

D. The Chicken-and-Egg Problem

E. Market Estimates

F. What is the Value Proposition for OSAM/OOS?

G. Further ReadingA. What is OOS + Sub-Segments of OOS

OOS (‘On-Orbit Servicing’) is a broad term that is used to refer to a range of inter-related services that can be provided to satellites while they are in orbit.

In-orbit / on-orbit (to me, both those terms are interchangeable and most people I come across within the industry use them as such) services (abbreviated to ‘OOS’) can be broken down into the following sub-categories

[1] Non-Contact Support (NCS) / In-orbit Inspection: The intended use-case is to assess the physical status and conditions of a satellite and potentially detecting anomalies or examining the consequences of an attack or collision. In other words, it refers to the operations — near the target — by the servicer that enhance the target’s capabilities or augment the servicer’s knowledge of the target. Of the various mechanisms that constitute OOS, it is the only function that does not require the servicer to dock or mate (not what you’re thinking) with the target. Examples of NCS include inspecting the target to assist in anomaly resolution, and/or remotely enhancing the target with a new capability using a wireless connection.

[2A] Repair: Repairing or replacing parts of a space system in orbit in order to extend or maintain the system in operational conditions; For instance, think of scenarios wherein a satellite would need replacing for a failed battery with a new battery and assisting a solar array that failed to properly deploy.

[2B] Refueling: providing and transferring propellant, fuel pressurants or coolants from the servicer spacecraft to the target one, in order to keep the system operational.

[2C] Reconfiguration: entails modifying the spacecraft’s payloads or modules in order to repurpose the intended mission of a space system.

[2D] Recharging: the act of providing electric power to a satellite in orbit through power beaming or docking.

[2E] Upgrade: entails the replacement or addition of components to a target satellite to enhance its capability. Some examples are replacing a flight processor with a more capable one via ORUs (an ‘Orbital Replacement Unit’1), or installing a new payload into an existing structural, electrical, data, or thermal interface on the target. Upgrade can occasionally overlap with assembly, depending on the intended operation.

[3A] Station-keeping: docking of the servicer spacecraft with a target satellite in order to keep the target in a particular orbit or attitude.

[3B] Relocation (or Orbit Correction): is when a servicer performs propulsion and attitude control functions for the target. Orbit modification, sometimes referred to as relocation or repositioning, is when the servicer spatially moves the client to a predetermined position and/or orbit.

[3C] Orbit maintenance, or assistance: is when the servicer performs the station-keeping and attitude-control functions for the client.

[3D] De-orbiting: refers to capturing a space system to relocate it to a graveyard orbit or to accelerate its atmospheric re-entry.

[3E] Recycling: retrieving the raw materials of orbiting rocket bodies to transform them into other space components or products.

Two key segments you will see conspicuously missing from this list are on-orbit assembly, and on-orbit manufacturing. While they are extremely vital for the sustenance and development of any form of in-space architecture, these markets may be beyond the purview for now given how long-term I personally view their development & maturity to be.

[4] On-Orbit Assembly (OOA): On-orbit assembly involves the on-orbit aggregation of components to build or add functionality to a spacecraft. Assembly is attractive for several potential applications.

First, it enables the deployment of spacecraft that are too large to be launched as monolithic systems. Consider the case of the ISS as an example. Its assembly required more than 40 space shuttle launches and 1,000+ hours of extra vehicular assembly2 (Boyd et al. 2016). The next generation of very large space telescopes (post-JWST) that could be too large, too heavy, or too delicate to launch in a single rocket fairing could also fall into this category.

Second, OOA can allow spacecraft hardware to be upgraded with new, higher performance technology. Updating communications payloads (discussed above) is an example of such an assembly mission.

Third, assembly of different payloads onto a persistent platform can provide flexibility and diversity for science missions. This category may include self-assembly of modular spacecraft that can reconstitute themselves for different purposes.

[5] On-orbit manufacturing: On-orbit manufacturing involves the on-orbit transformation of raw materials into usable spacecraft components. It primarily consists of sending raw materials into orbit (though the resources of space can also be used as raw materials and transformed in more advanced cases such as in-situ resource utilization / asteroid mining for example) and using machinery to turn the feedstock into the desired components.

Compared to on-orbit servicing and assembly, on-orbit manufacturing is in its technological infancy.

The simplest on-orbit manufacturing technique is additive manufacturing of single materials. For example, the first 3D printers in space used plastic raw materials to manufacture simple structures and tools.

More advanced 3D printers will use multiple materials, including metals, ceramics, and semiconductors.

Subtractive manufacturing techniques, such as milling and grinding, also an element of on-orbit manufacturing, are more challenging in space because of heat transfer and debris capture issues that we still haven’t figured out a solution to.

OOA and OOM are aspects that I will delve into at later stages during the successive iterations of this article / series, and for now, this piece will deal purely with on-orbit servicing (OOS).

B. Mission Sequence of the OOS Process

(Reproduced from DARPA CONFERS Initiative’s OOS Sequence & ESPI Policy Paper on In-Orbit Services)3

Rendezvous: the series of actions taken by the Servicer Spacecraft to transition its orbit from the departure of the previous customer or from its parking orbit to the desired rendezvous orbit by conducting an orbital transfer or maneuvers to reach the location of the rendezvous:

Initiate Rendezvous Action: The Servicer Spacecraft initiates action to rendezvous with the Client Space Object by performing an orbital transfer or phasing maneuver to achieve the desired rendezvous orbit. This action marks the beginning of the Servicer Spacecraft’s RPO operations.

Reposition Servicer Spacecraft to Client Space Object Vicinity: The Servicer Spacecraft performs additional orbital transfer and phasing maneuvers to achieve the desired RPO orbit.

Proximity Operations: the operations carried out between the servicer and the serviced spacecraft within close vicinity to each other. During this phase, separation between the two objects is typically controlled using on-board sensors to provide relative navigation.

One of three maneuvres / actions initiated:

Inspection / NCS (Item [1] from Section A): the servicer spacecraft does not come in physical contact with the inspected spacecraft but inspects it remotely by coming relatively close to the inspected spacecraft, acquiring data or images, or remotely exchanging data in order to assess the conditions of the space system; or

Docking: the servicer spacecraft can approach and establish physical contact by docking with the serviced spacecraft through a dedicated interface or by using another component in order to provide a service. Docking enables the servicer and the serviced spacecraft to exchange data, power, components, etc. and provide services such as refuelling, repair, reconfiguration, recharging, station-keeping, etc; or

Capture: the service spacecraft can capture a (usually) non-cooperative space object through various techniques such as robotic arms, nets, or harpoons. This often comprises Active Debris Removal missions.

Undocking or release: the operations in which the servicer spacecraft separates from the serviced spacecraft or manoeuvres away from it.

End of Mission: once the mission is over, the servicer can either manoeuvre towards another client, move back to its parking orbit, or de-orbit itself by re-entering the atmosphere or repositioning itself in a graveyard orbit when it reaches its own end of life

C. Demand-Side Drivers

Institutional Market Drivers:

The need for space sustainability and the increasing pressure to tackle the issue of space debris in crowded orbits is pushing institutional demand and capability building: In the past few years, some States have expressed their willingness to act on the matter either through legal means by prohibiting or regulating the creation of debris, or through technological means such as enhanced Space Traffic Management (STM) and Space Situational Awareness (SSA), Active Debris Removal (ADR) or life extension.

The Weaponization of Space is also prompting states to invest in resilience, one of which is through OOS capabilities: The fear of other nations possessing ASATs is a strong institutional demand generator for in-orbit services. Strategic reasons necessitate that in the event that space systems get damaged by an adversary’s spacecraft or ASAT, they will require maintenance and repair operations in order to be kept in operational conditions. An intentional collision between two space objects could also increase the demand for the ADR / debris de-orbiting segment of the market.

An additional consideration to factor in would be that due to the inherent dual-use nature of SpaceTech, it could be of interest to some governmental actors from the perspective of a potential outer space warfare capability building.

Institutional Role as Anchor-Customers/Investors: Given the cycle of technology adoption, specially with the long gestation periods involved in the space sector, institutional interest and investment can stimulate the demand for in-orbit services as public institutions are trusted to possibly function as anchor-customers that can help make the case for such technologies and systems and encourage private companies to consider this market.

In-space architecture & Space Exploration: One of the first use-cases that led to the early-stage development of OOS was to be able to service the ISS and the HST. As plans to build sustained, long-term presence on the Moon and Mars begin to pick up pace, so will the demand for OSAM (even for on-orbit assembly and on-orbit manufacturing segments, not just OOS). Missions of such a calibre will require on-orbit assembly for building large and complex infrastructures. Even discussions of harnessing potential for asteroid mining require such capabilities to function as the building blocks.

Commercial Market Drivers:

The convergence of several factors from the other segments of the SpaceTech sector has also had a slow, but steady impact in creating an interest in OOS capabilities:

Reduced launching costs and rising commercial launch capabilities can enable state actors and private companies to launch more affordable and cost-effective in-orbit services.

Increased number of space systems in orbit, in particular large satellite constellations will create a high market demand for maintenance, repair and de-orbiting services in the next decades.

Easier access to VC and private funding can enable an easier development of in-orbit services and give the possibility to start-ups to demonstrate their innovative technologies and enter this emerging business more easily.

Lack of restraining regulations, standardization or international framework allow newer space companies to develop innovative systems for in-orbit operations with reduced constraints.

Increased availability of public and private SSA data can make the demonstration of in-orbit services more secure and enhance companies and investors’ confidence in the feasibility and profitability of IOS.

Emergence of Open Source Satellite OS such as NASA Core Flight System or Satellite-as-Service (SaaS) are meant to enable start-ups that do not benefit from the expertise or experience of established space companies to mostly focus on mission specific applications related to IOS and accelerate the development of their system and their entry to market.

D. The Chicken-and-Egg Problem for OSAM

I remember from my last time speaking at the Indian Conference on Space that happened a couple of months ago, someone from the audience had posed a simple (which by no means is a slight, as I believe a lot more of us should ask simple and obvious questions instead of glossing over them under the belief that someone may have figured it out), yet profound question: What is needed to further the OSAM market or the OOS market to begin with? I am afraid I don’t have a direct answer to that question because it’s a classic example of the chicken-and-egg problem. It is abundantly clear at this point that the challenge is not technological, at least not for furthering or growing the OOS market.

One will argue that the real economic challenge lies in determining the value of servicing and then finding a business case that seals such an argument.4 For the simplest case, the economic aspects of on-orbit servicing include comparing the cost of a servicing mission to the cost of replacing the failed satellite as well as the potential returns from the serviced satellite. The returns can be revenue, scientific data, or continued and improved operations. The simplest case is for commercial communications satellites.

Failure of Orion 3: For instance, take the 1999 Orion 3 satellite, which cost $150 million to design, develop and manufacture (plus $80 million for the launch) and was inadvertently placed in an incorrect orbit, resulting in a $265 million insurance payout. The potential operating revenue per year was around $43 million. Because the design life of the satellite was 15 years, $645 million in potential revenue was lost. It is undeniable that an OOS mission could have been developed for a fraction of that price - at least in India if not the US. So then what is the issue holding this back from imploding?

Looking at the OSAM market, this slow development appears two-fold and may be explained by phenomena taking place on both the demand and the supply side:

Supply: In general, industry primes whose revenues are regularly replenished by orders for new satellites may have been less incentivized to invest or co-fund R&D in areas that could reduce those revenues such as OSAM. Therefore, there may have been more interest from these satellite manufacturers to sell brand new satellites than sell on-orbit servicing solutions. With the barriers to entry lessening, new entrants have emerged, driven partly by the increasing awareness of the space debris and congestions issues by government and industrial actors alike; so this situation may evolve in the future. Industry primes are slowly seeing the benefit of entering this market, which can be seen as a complement from satellite manufacturing by generating revenues from maintenance as well.

Demand: the market may have been slow to take off because operators may not necessarily see the need to contract OSAM services. From a sustainability point of view, nothing requires operators to make their systems serviceable or contract ADR services at the end of their systems’ lifecycle or should they create debris or lose control of their satellite.5 Also, as only few commercial missions took place, OSAM missions can be seen as expensive, not yet fully operational, and therefore seen as a potentially risky. The launch of mega-constellations is also a reducing factor as operators benefit from a high redundancy, with a great number of small satellites, which may not prompt operators to contract OSAM missions in case of failure on one of their spacecrafts.

This, in essence, constitutes the ‘Chicken-and-Egg Problem’ related to technology development in the OSAM segment. It has been a primary barrier in the development of the commercial side of the market despite technology being validated and demonstrated. Consider the curios case of Northrop Grumman’s Mission Extension Vehicle - 1 (MEV-1), deployed in 2019 for Intelsat 9016.

Northrop Grumman & Intelsat: Northrop Grumman, one of the 'defense primes', had developed the MEV-1, which was subsequently used to service the Intelsat's IS-901 satellite. To do so, Intelsat raised the altitude of IS-901 so as to match the one of the MEV-1 servicer. MEV-1 performed a rendezvous and docked with IS-901 by using the liquid apogee engines to grab Intelsat’s satellite as it was not initially designed to be serviced. Initially, to test its capabilities, MEV-1 took over the propulsion and altitude control functions of the serviced satellite and relocated it to a graveyard orbit. The demonstration mission was conducted in graveyard orbit to reduce risk of collisions with active satellites in GEO. Once this capability was confirmed, MEV-1 eventually proceeded to relocate IS-901 to its intended orbital slot in GEO. In 2024, IS-901 is expected to be placed into graveyard orbit after its end of life. Building on this success, in 2020, Northrop Grumman launched its successor, Mission Extension Vehicle-2 (MEV-2) to service Intelsat’s 10-02 satellite. MEV-2 directly docked 10-02 in GEO and has remained docked to the satellite, thereby extending its operational lifespan for a period of five years to provide altitude control and station-keeping.

Many expected this to be the moment when the interest in the OOS segment explodes. And the expectation was more than warranted. The economic value of on-orbit servicing was net positive for Intelsat as it increased its Return on Investment (RoI) on its existing satellites, saving around $200 to 400 million for a cost of around $70 million ($13-14 million per year over five years). And yet, it didn’t. And there is a deeper, more rooted issue at play here.

Satellite owners have been unwilling to pay for features to make servicing easier, because there have been no operational servicers thus far. Adding to that issue is the aspect that operators may only require such a service for a small portion of their existing fleet. On the other hand, companies interested in offering OOS need an adequate, addressable market to justify the substantial capital investment required to develop servicers capable of performing operations on legacy satellites.

Fortunately, some satellites have required OOS to perform their missions and have thus overcome the economics of developing servicing technologies. For example, both the Hubble Space Telescope (HST)7 and the International Space Station (ISS) required OOS and hence significant efforts & investment were made to service these missions. Investments from the institutional side through governmental agencies such as NASA, DARPA, and commercial entities are driving down the cost of developing robotic servicers.

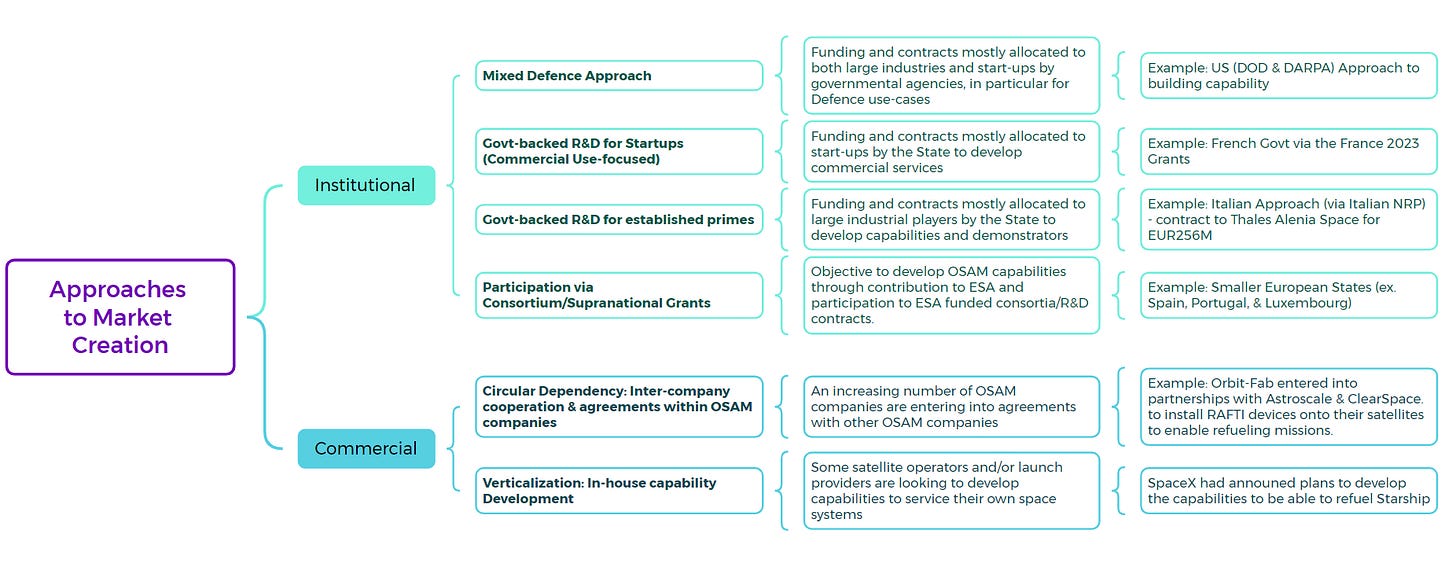

Let’s take a look at the approaches towards market creation that have been adopted from (a) the institutional side; and (b) the commercial side to understand this a little better.

As one may see, different dynamics between Institutional and Commercial actors have emerged. This emerging market can be characterized by the presence of different types of contracts and origins of demand.

E. Market Sizing & Estimation

A lot of times when market sizes for disruptive / long-development technology is considered, people adopt one of two views: (a) ‘We are bullish on it and this would be a game changer’; or (b) ‘The numbers are baloney’. While I do not wish to get into the question of sizing the potential market for several reasons, I will however, for your perusal, quote different statistics and estimates that analysts across the board have reached at using different methodologies:

Northern Sky Research Report on OSAM: $14.3 billion by 2031

Life Extension Services: $4.7 billion

SSA Segment: $3.7 billion

Active Debris Removal (ADR) growing at 38% CAGR

Euroconsult Report on Space Logistics (2023): Evaluated two potential scenarios, one optimistic and one conservative

Optimistic Scenario for 2032 Estimate: $5 billion

Baseline Scenario for 2032 Estimate: $4 billion

Conservative Scenario for 2032 Estimate: $3 billion

SSA Segment: $1.8 billion

Research & Markets (2022): Surprisingly, they have 2 different reports (and both are for OOS) from the same year of publishing with varying estimates:

Report 1: 2030E pegged at $5.1 billion with current market sizing of $2.2 billion;

Report 2: 2030E ~$7 billion

As always, if relying on these numbers, do so at your own discretion post an analysis of their purported methodologies etc.

F. What is the Value Proposition for OSAM?

The Answer: Bloody Good Question. We will explore that in the next part of this series, where we deep-dive into the question of what the value proposition is for OSAM, considering both the perspective of the customer (i.e. the owner of the target satellite) as well as the servicer / OSAM provider. We will also be taking into consideration the different choices (through logic trees) that different scenarios may possibly present in such cases.

In addition, some policy considerations, technology enablers, market maturity levels and trigger points for widespread technology adoption will also be delved into.

G. Sources For Further Reading

Aerospace Corporation Brief on OSAM

Aerospace Security Report on OSAM

European Commission, Guidance Document for Horizon Space Work Programme 2022

DARPA CONFERS OOS Framework

P.S. Also, to my 10K+ subs that stuck on, thank you for your support!

The ORU, also often referred to / corollary to an ‘Orbital Replacement Instrument’ (ORI) were essentially a design functionality for key elements and components built into the International Space Station and the Hubble Space Telescope to enable their replacement after their operational lifespan ended in order to ensure that these structures could continue to functional optimally. These modular design ideas were predicated on the creation of interface designs such as grabbing interfaces, mechanical docking interfaces, and multifunctional docking interfaces. Although no directly, publicly available study on ORUs or ORIs exist, one can get a decent understanding of the basic architecture and historical development by reviewing: Ren, Kong & Liu on ‘A review on the interfaces of orbital replacement unit: Great efforts for modular spacecraft’

Boyd et. al, ‘State of the Art in On-Orbit Assembly’, from the On-Orbit Manufacturing and Assembly of Spacecraft (2017)

ESPI, In-Orbit Services

Liu et al., Economic value analysis of on-orbit servicing for geosynchronous communication satellites, Acta Astronautica 180 (12) [2020]

For more details, see: Docking gives Intelsat Telecoms satellite new lease of life, BBC News

For more information, see: https://hubblesite.org/mission-and-telescope/servicing-missions